Guilin Bank is a leading city commercial bank in China. In July 2018, the global authoritative financial media, The Banker magazine from the UK, released its "Top 1000 World Banks" list, where Guilin Bank ranked 434th, improving by 111 positions from 545th in 2017. It ranks 69th among domestic banks.

Established in March 1997 as Guilin City Commercial Bank, the bank is a new type of joint-stock commercial bank initiated by the Guilin Municipal Finance Department and local enterprises. In March 2017, Guilin Bank successfully completed the capital registration change to 3 billion RMB and concluded the introduction of China General Nuclear Power Group as a strategic investor.

In recent years, Guilin Bank has experienced rapid and steady growth. As of December 2018, the bank's total assets exceeded 260 billion RMB.

While introducing strategic investors to supplement capital, Guilin Bank has consistently pursued the goal of integrating "introduction of talent, technology, and capital" to leverage external advanced management experiences for its own leapfrog development. The construction of a "Process Bank" and the "creation of a process-oriented organization" are key directions identified by the bank.

Realscheme Management Consulting Group, as a long-term strategic partner of China General Nuclear Power Group in consulting services, became the solution design and implementation partner for Guilin Bank's Process Bank Construction Project.

This Process Bank Construction Project fully implements the bank’s philosophy of "specialized operations, refined management", with the goal of "institutionalized management, process-oriented systems, standardized forms, and electronic forms", focusing on "clear responsibilities, streamlined processes, effective internal control, and improved efficiency." The project aims to build standardized systems, visualized processes, and standardized templates, applying advanced process concepts and information technology to construct an industry-leading commercial bank governance and service model. This will enhance the management and support capabilities of the head office and middle/back-office departments, while unleashing the marketing and service vitality of front-office departments and branches, improving customer reputation and market competitiveness. The goal is to achieve "initial results within one year, significant results within two years, and comprehensive improvement in three years".

From the perspective of process management, the project aimed to improve the management norms of Guilin Bank by addressing the issues of responsibility boundaries, information flow, and management channels between various departments, business lines, products, and platforms.

Based on leading process management concepts and methods, and combining the bank’s business characteristics, a comprehensive survey and analysis of six key business lines — corporate business, personal business, risk management, finance and technology, general management, and audit and supervision — was conducted. The process involved unified planning, phased actions, effective control, and efficient implementation, achieving the expectations of the bank’s management team.

During the project, over a hundred interviews and discussions with management and key employees across various departments, as well as the review of over a thousand management documents, allowed the team to understand the business status. The analysis and summary covered various dimensions, including organization, operations, performance, systems, processes, and IT, with recommendations and planning for future improvements.

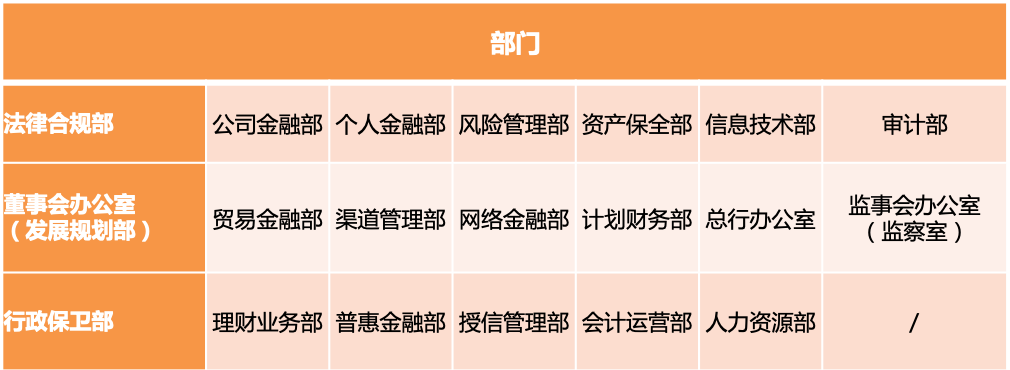

(Appendix: Main Primary Departments of Guilin Bank)

Methodology Integration: Based on methodologies such as the "PDCA Cycle," "Lifecycle Management," and "Business Domain Classification," and considering the characteristics of the financial industry and different business management domains, as well as external regulatory and internal compliance requirements, the project team conducted discussions to define the management framework and top-level process design for Guilin Bank.

Integration of Systems and Process Management: Achieved an organic integration of policies and processes, as well as classified management. Within the bank, a process management system was defined based on the process architecture, process flow diagrams, process descriptions, and template forms, with a clear principle of classified management for policies, regulations, standards, methods, and guidelines.

Systematic Mapping of Policies and Processes: By conducting a systematic review of each business line, department, and function, a multi-level matching of policies and processes was completed. A comprehensive process list covering all areas and business functions was created, along with a structured plan for ongoing process establishment and optimization.

Optimization of Key Management Processes: The project team restructured and optimized critical management processes and forms, improving the business and management logic in key areas.

IT Integration: In collaboration with Guilin Bank’s third-party IT team, the project introduced IT management tools for policy and process information management.

Establishing a Management Foundation: The project laid the management foundation for Guilin Bank's dual-headquarters operations in Guilin and Nanning, providing a solid management framework for the bank's rapid branch expansion.

Clear Definition of Business and Process Architecture: The business and process architecture for Guilin Bank was clearly defined, identifying key value areas such as strategy, risk, products, marketing, operations, services, finance, human resources, and general management.

Process Management Ownership: The management responsibility for policies and processes was clearly defined. The introduction of process management tools and methods empowered and guided their application within Guilin Bank, establishing a foundation for building an efficient organization and team.

Previous article:Xinyi Technology Co., Ltd.

Next article:Xinfoton Optoelectronics Technology Co., Ltd.

This is a promotional slogan