Leyard Optoelectronic Group (Stock code: 300926) is a multinational group formed by more than 40 domestic technology and cultural enterprises, with a workforce of 3,500 employees, including 600 foreign nationals. The group generates 41% of its revenue from international markets. Leyard focuses on four major industries:

LED Displays (ranked No. 1 globally),

Urban Landscape Lighting (the largest in China),

Cultural Technology Integration, and

Virtual Reality (Interactive Technology).

In 2017, the group was recognized as one of the Top 100 Enterprises in China’s Electronic Information Industry by the China Electronics and Information Industry Federation, and ranked among the Top 10 Enterprises in Beijing.

The traditional LED market faces intense competition, and there is a lack of strategic growth space in terms of market expansion and profitability.

Investors expect Leyard to transform from a hardware manufacturer to a more comprehensive technology company.

The rapid external acquisitions have not achieved the anticipated synergies, resulting in “indigestion” issues.

The company aims to more effectively increase its stock price and engage in more efficient financing strategies.

Leyard seeks to build stronger brand influence and recognition.

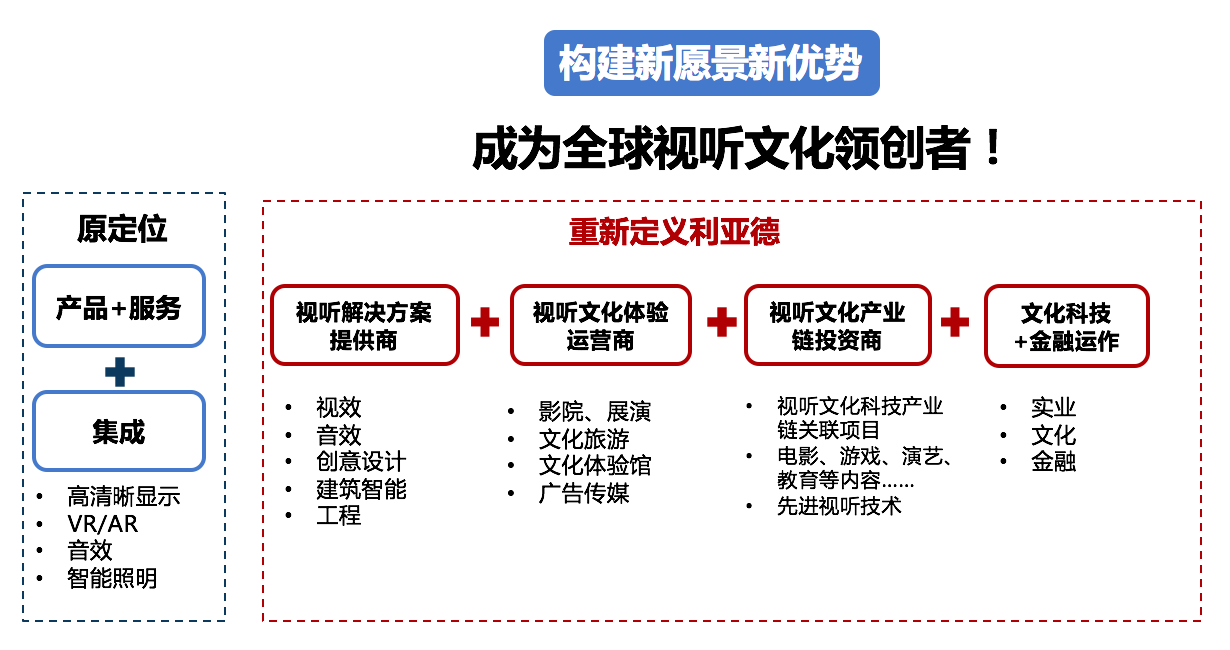

Redefining the Company: The project aimed to redefine Leyard’s business model, exploring new industry boundaries and creating a new vision and strategic advantage for the company.

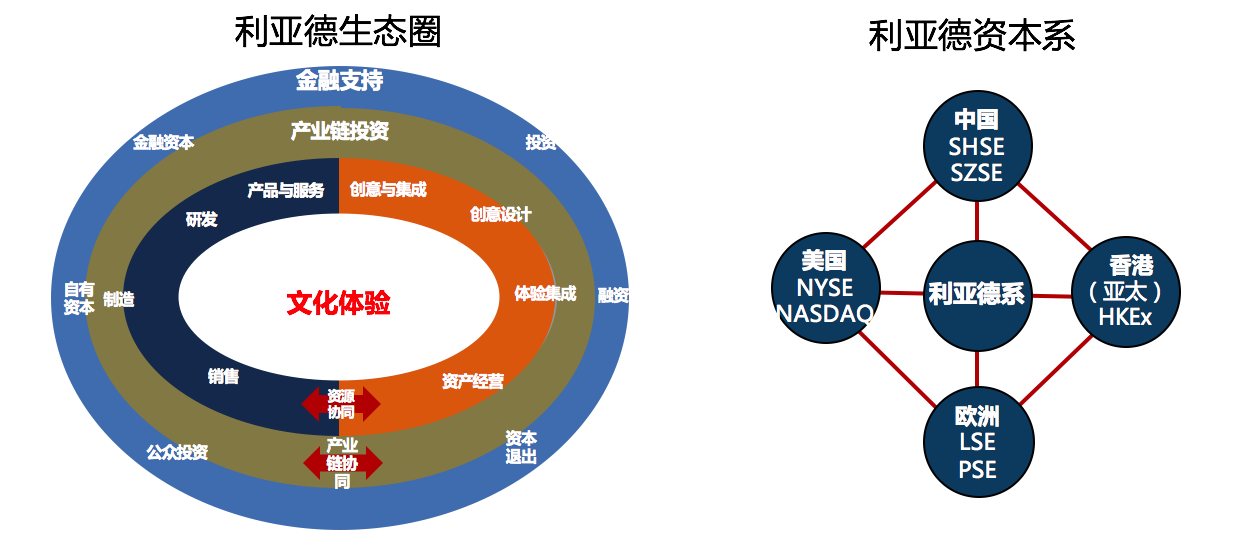

Building a New “Cultural Technology + Finance” Business Model: The project focused on creating a new business model that integrates cultural technology with finance, positioning Leyard as a leader in the global audio-visual and cultural industry.

Creating a New Vision of “Global Leader in Audiovisual Culture”: The project aimed to redefine Leyard’s market positioning and long-term goals, with the vision of becoming a “Global Audiovisual Culture Leader”.

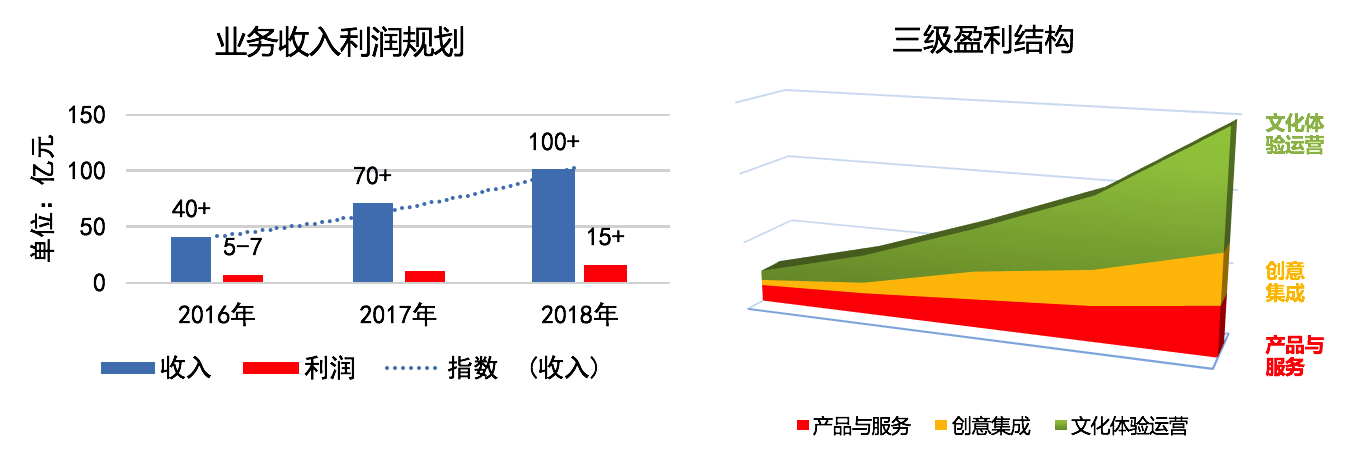

Aiming for “Leyard with a 100 Billion RMB Valuation”: The strategic goal is to elevate Leyard to the scale of a 100 billion RMB enterprise, expanding its influence in the global market and driving long-term growth and profitability.

Stock Price Surge: The day after the release of Leyard’s new strategy, the stock price opened sharply higher and closed near the daily limit.

Revenue and Profit Growth: Since the implementation of the strategy in 2016, Leyard’s revenue and net profit growth rates have significantly outpaced the industry average.

Successful Mergers and Acquisitions: All acquisitions achieved the target performance metrics through strategic synergies, exceeding expectations.

Higher Valuation and Market Performance: Since the strategy's implementation in 2016, Leyard’s price-to-earnings ratio (P/E) and market capitalization have maintained a strong linear growth, far exceeding its industry peers.

Previous article:Shenzhen Institute of Building Research Co., Ltd.

Next article:Guangfa Bank's Credit Card Center

This is a promotional slogan